iowa capital gains tax on property

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction on qualifying capital gains as specified in a.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Iowa Form 100E - Iowa Capital Gain Deduction - Business.

. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Before you complete the applicable Iowa Capital Gain Deduction IA 100 form review the Iowa Capital Gain Deduction Information Guide. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form.

Understanding what qualifies for capital gains tax when to realize capital gains or capital losses and what your capital gains tax rate will be is a. Iowa has a unique state tax break for a limited set of capital gains. In general two major requirements must be satisfied to get the deduction.

To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. However counting to 10 or five apparently is not easy for some taxpayers and their legal counsel. When a landowner dies the basis is automatically reset to the current fair market value at the time of death.

To claim a deduction for capital gains from the qualifying sale of timber complete the IA 100D. For tax years beginning on or after January 1 1998 net capital gains from the sale of the assets of a business described in subrules 40382 to 40388 are excluded in the computation of net income for qualified individual taxpayers. Introduction to Capital Gain Flowcharts.

How are capital gains taxed in Iowa. To claim a deduction for capital gains from the qualifying sale of a business complete the IA 100E. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000.

Iowa Capital Gains Tax. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Long-term capital gains tax is a tax applied to assets held for more than a year.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Both long- and short-term capital. The table below summarizes uppermost capital gains tax rates for Iowa and neighboring states in 2015.

The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Laws passed in 2018 and 2019 would have restricted the availability of the Iowa capital gain deduction beginning in 2023 to sales by those who met these. Moreover the deduction could not exceed 17500 for the tax year.

Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The states income tax system features one of the highest top rates which at 853 ranks among the highest states.

1 the property being sold must have been held by the taxpayer for the immediately preceding 10. Links to the Iowa. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or five once retirement occurs.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if required for federal purposes. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898 percent to 853 percent in 2019.

Even so with an effective property tax rate of 153 Iowas property taxes are the 11th-highest in the country. Other information in addition to that identified on the. The tax rate on most net capital gain is no higher than 15 for most individuals.

The following is a resource to outline these basic qualifications and should be used in conjunction with the appropriate IA 100 form. Iowa is a somewhat different story. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Iowa Form 100B - Iowa Capital Gain Deduction Real Property Used in a Non-Farm Business.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Property tax See also. Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains.

What is the Iowa capital gains tax rate 2020 2021. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. The Iowa capital gain deduction Iowa Code 4217 is 100 percent for qualifying capital gains.

Under this provision the. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Iowa. To claim a.

The law modifies the capital gain deduction allowed for the sale of real property used in a farming business beginning in tax year 2023. The tax provisions allow landowners to sell property but defer the tax under Section 1031. To claim a deduction for capital gains from the qualifying sale of timber complete the IA 100D.

A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes. These rates are typically much lower than the ordinary income tax rate. But it also has one of the lowest bottom rates.

To claim a deduction for capital gains from the qualifying sale of a business complete the IA 100E. Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. This provision is found in Iowa Code 422721.

What is the percentage of capital gain tax on property.

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

2022 Capital Gains Tax Rates By State Smartasset

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Iowa Landowner Options

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax Iowa Landowner Options

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2022 Capital Gains Tax Rates By State Smartasset

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

What Are Capital Gains Tax On Home Sale In Dallas

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

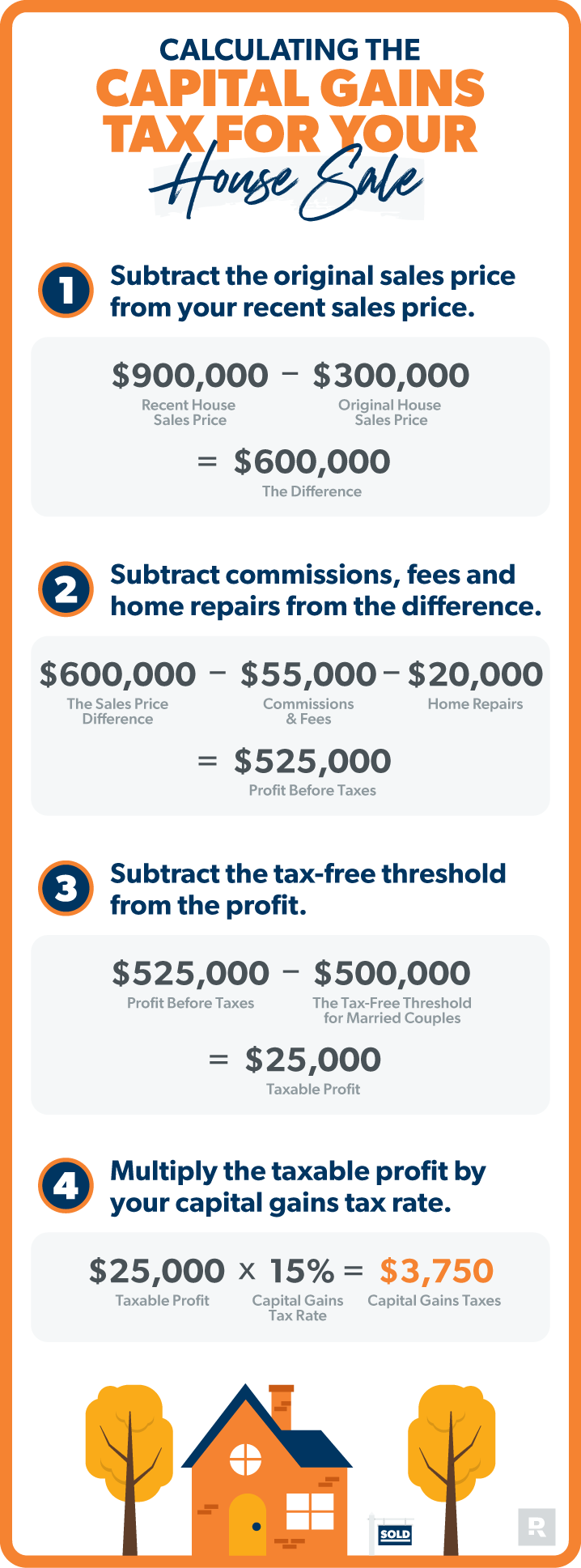

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com